Fascination About Estate Planning Attorney

Table of ContentsNot known Details About Estate Planning Attorney Some Known Questions About Estate Planning Attorney.All about Estate Planning AttorneyEstate Planning Attorney Fundamentals ExplainedThe Ultimate Guide To Estate Planning Attorney

A knowledgeable attorney who recognizes all aspects of estate planning can aid guarantee customers' wishes are performed according to their intents. With the right support from a reliable estate coordinator, people can feel positive that their strategy has been produced with due treatment and attention to detail. People require to spend sufficient time in discovering the ideal lawyer who can use audio suggestions throughout the whole procedure of creating an estate strategy.The documents and directions produced throughout the preparation procedure end up being lawfully binding upon the customer's fatality. A professional financial advisor, based on the desires of the departed, will after that start to disperse trust assets according to the client's directions. It is very important to keep in mind that for an estate strategy to be efficient, it needs to be appropriately applied after the customer's fatality.

The selected administrator or trustee need to make sure that all properties are dealt with according to legal requirements and according to the deceased's desires. This normally entails collecting all documentation related to accounts, investments, tax records, and other items specified by the estate strategy. Additionally, the administrator or trustee may need to coordinate with creditors and recipients entailed in the circulation of possessions and other matters relating to clearing up the estate.

In such scenarios, it may be necessary for a court to intervene and resolve any kind of disputes before final circulations are made from an estate. Inevitably, all aspects of an estate have to be resolved effectively and accurately based on existing legislations so that all events included receive their reasonable share as meant by their loved one's dreams.

What Does Estate Planning Attorney Do?

People need to plainly understand all elements of their estate strategy before it is propelled (Estate Planning Attorney). Functioning with an experienced estate preparation attorney can assist make certain the files are effectively drafted, and all assumptions are met. Furthermore, a lawyer can provide insight right into how different lawful devices can be utilized to secure assets and optimize the transfer of wide range from one generation to another

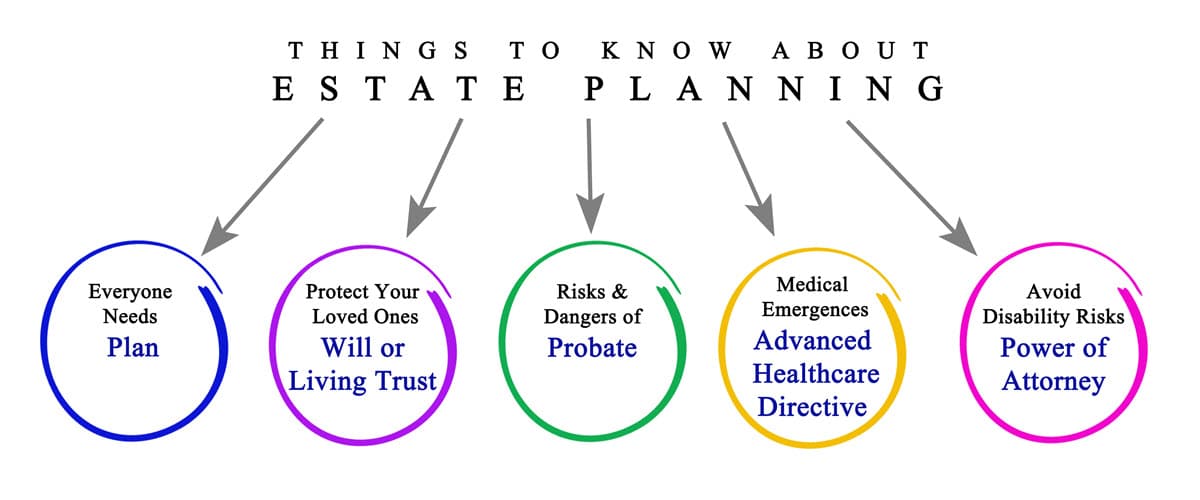

Estate intending describes the preparation of jobs that handle a person's monetary situation in the event of their incapacitation or fatality - Estate Planning Attorney. This preparation consists of the bequest of assets to heirs and the negotiation of inheritance tax and financial obligations, together with other factors to consider like the guardianship of small kids and animals

Several of the actions consist of listing assets and debts, assessing accounts, and creating a will. Estate planning jobs include making a will, establishing trust browse around this site funds, making philanthropic donations to restrict estate tax obligations, naming an administrator and recipients, and setting up funeral setups. A will gives guidelines regarding residential or commercial property and protection of minor youngsters.

Little Known Questions About Estate Planning Attorney.

Estate preparation can and should be utilized by everyonenot simply the ultra-wealthy., took care of, and dispersed after fatality., pension plans, debt, and much more.

Any person canand shouldconsider estate preparation. Creating a will is one of the most vital actions.

Keep in mind, any type of accounts with a recipient pass straight to them. Make sure your beneficiary details is current and all of your various other info is accurate. Establish up joint accounts or transfer of fatality designations.

The Facts About Estate Planning Attorney Uncovered

8. Write your will. Wills don't simply untangle any type of financial unpredictability, they can additionally lay out strategies for your small youngsters and animals, and you can likewise advise your estate to make charitable donations with the funds you leave. 9. Testimonial your records. Make certain you look over every little thing every couple of years and make adjustments whenever you please.

Send out a copy content of your will certainly to your administrator. This makes sure there is no second-guessing that a will exists or that it obtains shed. Send one to the person who will certainly think obligation for your events after you pass away and maintain another copy somewhere safe. 11. See a monetary expert.

See This Report about Estate Planning Attorney

There are tax-advantaged financial investment vehicles you can make use of to aid you and others, such as 529 university financial savings plans for your grandchildren. A will is a legal paper that supplies directions regarding just how a person's residential or commercial property and protection of minor children (if any type of) must be dealt with after death.